Despite rising home prices and mortgage rates, more young adults are finding ways to emerge in the housing market and purchase their first home. But they’re increasingly turning to family and friends for help with affording a down payment.

Millennials, ages 25 to 43, now comprise 38% of the homebuying market, up from 28% a year ago, according to the National Association of REALTORS®’ newly released 2024 Home Buyers and Sellers Generational Trends Report. Meanwhile, NAR’s report shows that baby boomers, aged 59 to 77, purchased fewer homes at 31% of transactions, relinquishing their top position among homebuying demographics.

“The generational tug-of-war between millennials and baby boomers continued this year, with millennials rebounding to capture the largest share of home buyers,” says Jessica Lautz, NAR’s deputy chief economist and vice president of research. “This notable rise is attributed to both younger millennials stepping into homeownership for the first time and older millennials transitioning to larger homes that suit their evolving needs.”

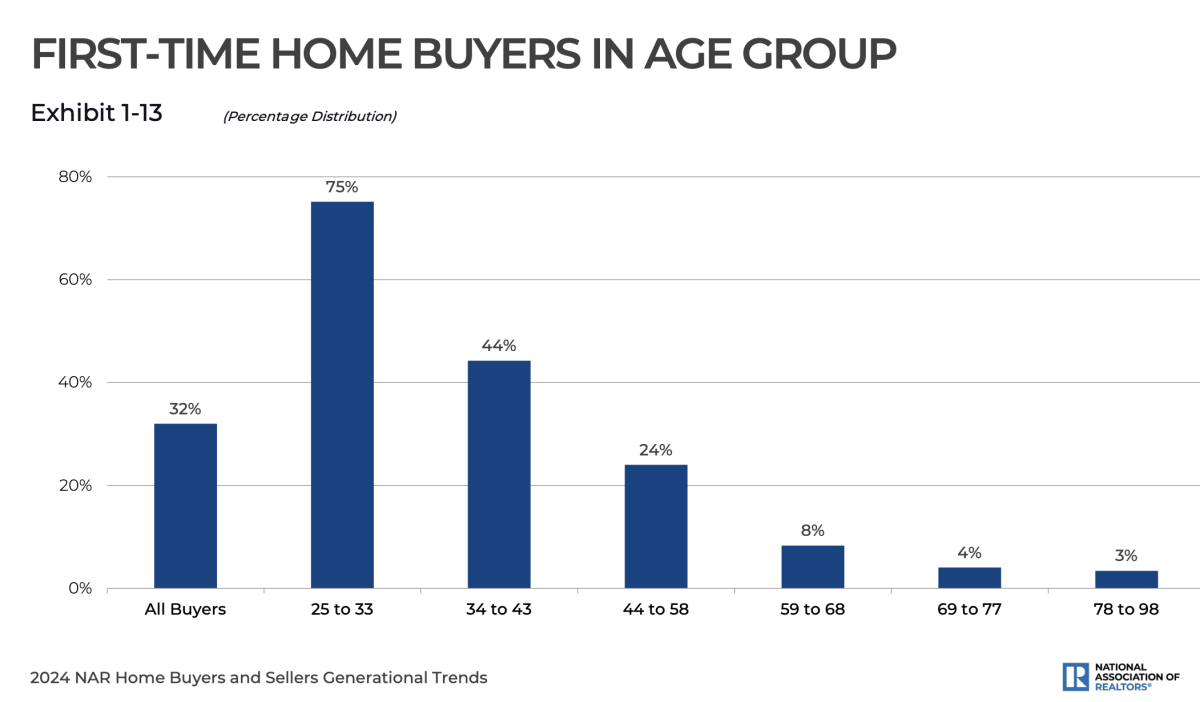

First-time buyers made up 32% of all buyers, up from 26% a year ago, NAR’s generational study says. That’s shy of the historical norm of 40%, but economists still see signs that more younger adults are entering the housing market. Among younger millennials, between 25 and 33 years old, 75% were first-time buyers, while 54% of Generation X buyers, between the ages of 44 to 58, and 44% of older millennials, ages 34 to 43, were first-time buyers.

However, first-time home buyers weren’t always able to achieve homeownership without some help. The latest NAR survey finds a quarter of younger millennials received down payment help in the form of a gift or loan from a family or a friend, the latest NAR survey finds.

Buyers are also looking to pool money with others to afford homeownership. For example, millennials were the most likely generation to say they purchased a multigenerational home, which could involve adult siblings, adult children, parents and grandparents, so they could afford a larger home by pooling multiple incomes. They were also more likely to cite cost savings as an appeal of multigenerational housing.

Down Payment Challenges Persist

Saving for the down payment remains the top challenge of first-time home buyers. Student loans and high rents were commonly blamed for delaying their home savings, followed by credit card debt and car loans. Besides turning to relatives and friends for help, home buyers between the ages of 25 to 33 years old tapped into their savings and looked into the sale of stocks or bonds (13%) and finding other sources, such as 401(k) and pension funds or loans (7%), NAR’s research shows.

The median down payment for a home purchase for those between the ages of 25 to 33 was 10%, while it was 13% for ages 34 to 43, according to NAR’s report. Older adults had the largest down payments at 22%, for ages 59 to 68, and 35% for ages 69 to 77. Older buyers often can use the equity from a past home to finance their next home purchase, the study says.

Indeed, “first-time home buyers continue to struggle to enter the housing market, lacking the housing equity that boosts the purchasing power of repeat buyers,” Lautz recently testified to the House Committee on Financial Services Subcommittee on Housing and Insurance.

Lautz points to a lack of awareness among consumers about down payment assistance programs and loan products with low down payment options. Since 2009, the share of buyers with FHA loans, which have low down payment requirements that help first-timers and low-income buyers, has dropped by half. “Many prospective home buyers may be unaware of low down payment products that could bring homeownership closer within reach,” Lautz said.

Eager to Buy

Young adults show a strong desire to get into homeownership, whether using a relative’s financial gift, pooling money with others, or finding other methods.

Eighty-two percent of all buyers viewed a home purchase as a good financial investment, and that was even more so the case—at 86%—among those ages 25 to 33 years old, the study says. “The universal value of owning a home transcends every generation, serving as a cornerstone for both personal prosperity and community development,” says Kevin Sears, 2024 NAR president.